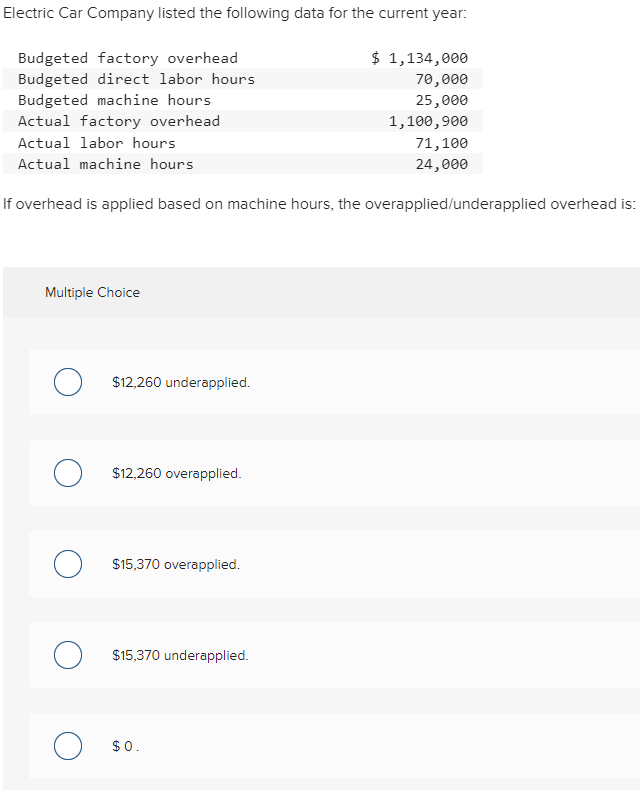

Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. This process is done by estimating a predetermined debt to equity d overhead rate that can be used to split costs between jobs and departments. At the end of the period, the estimated costs and the actual costs incurred are compared.

6 Determine and Dispose of Underapplied or Overapplied Overhead

Regular variance analysis and monitoring are crucial for identifying and correcting both overapplied and underapplied overhead. By maintaining accurate overhead allocation, companies can improve their financial reporting and make more informed strategic decisions. Adjusting journal entries are necessary to correct the financial distortions caused by overapplied overhead. These entries ensure that the financial statements accurately reflect the company’s actual costs and financial position. The process begins by identifying the amount of overapplied overhead, which is the difference between the allocated overhead and the actual overhead incurred.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Now the machine shop has to book an additional $600 of overhead expense because the original estimate what under applied. In this book, we assume companies transferoverhead balances to Cost of Goods Sold. We leave the morecomplicated procedure of allocating overhead balances to inventoryaccounts to textbooks on cost accounting. If not adjusted, the overapplied amount can lead to an overstatement of net income. This can have tax implications, as higher reported earnings may result in a larger tax liability.

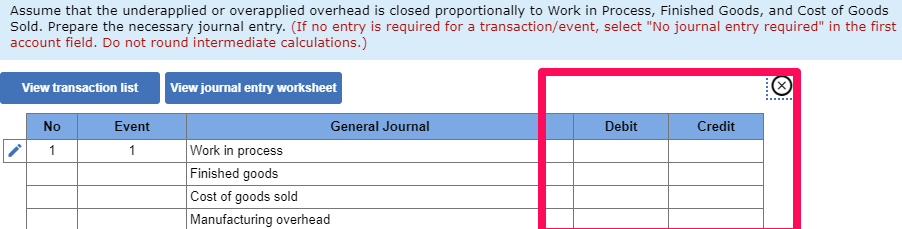

Journal entry for overapplied overhead

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. He received a CALI Award for The Actual Impact of MasterCard’s Initial Public Offering in 2008. McBride is an attorney with a Juris Doctor from Case Western Reserve University and a Master of Science in accounting from the University of Connecticut.

What Is Underapplied (vs. Overapplied) Overhead in Budgeting?

- If the company booked $4,000 of estimated overhead at the beginning of the quarter, it would have to reverse the overapplied overhead, so estimated overhead booked matches the actual overhead incurred for the period.

- In this case we would, debit the factory overhead account and credit the cost of goods sold account for the difference.

- When underapplied overhead appears on financial statements, it is generally not considered a negative event.

- These tools enable companies to quickly identify and address discrepancies, reducing the likelihood of significant overapplied overhead at the end of the accounting period.

- For example, on December 31, the company ABC which is a manufacturing company finds out that it has incurred the actual overhead cost of $9,500 during the accounting period.

Advanced cost accounting software, such as QuickBooks and Microsoft Dynamics, can automate the tracking of overhead costs and provide real-time insights into cost variances. These tools enable companies to quickly identify and address discrepancies, reducing the likelihood of significant overapplied overhead at the end of the accounting period. Additionally, regular training and development for accounting staff can ensure that they are equipped with the latest knowledge and skills to manage overhead effectively.

Overapplied Overhead Definition Becker

Moreover, overapplied overhead impacts the balance sheet by inflating inventory values. Since overhead costs are initially allocated to inventory, an overapplication results in higher inventory valuations. This can distort the true financial position of the company, as the assets on the balance sheet appear more valuable than they are.

This will result in an excess charge of $15,000 to the cost of goods sold, if the situation is not corrected. To do so, the company’s controller debits the manufacturing overhead cost pool for $15,000, while crediting the cost of goods sold account for the same amount. The result is a cost of goods sold that incorporates only the actual overhead costs incurred during the month of March. Addressing underapplied overhead involves adjusting journal entries to increase COGS and inventory values, thereby aligning them with actual costs. This adjustment ensures that financial statements accurately reflect the company’s expenses and profitability.

For example, the manufacturing company ABC finds that it has a $2,000 debit balance of the manufacturing overhead at the end of the accounting period. Understanding how to manage overapplied overhead ensures accurate financial reporting and helps maintain budgetary control within an organization. The machine shop estimates that its overhead will be $1,000 a month for next three months. After the quarter has ended, it turns out that total overhead incurred for the last three months was $3,600—not $3,000.

Likewise, it needs to debit the manufacturing overhead account as in the journal entry above. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. Essentially, overapplied overhead means that a company has applied, or charged, less in overhead costs than it actually incurred.

Likewise, after this journal entry, the balance of manufacturing overhead will become zero. Even though overhead doesn’t affect cash flows, it still shows up in the bottom line or net income. Most managers want to be able to show a profit even after overhead expense, so an estimated amount of overhead is applied for each period. After this journal entry, the balance in the manufacturing overhead account will be zero as it should be our goal to make it zero at the end of the accounting period. Advancements in electronic inventory and production management systems have greatly eased the burden of comprehensive operational reporting, often including underapplied overhead analysis.