Contents

The most basic forms of forex trades are a long trade and a short trade. In a long trade, the trader is betting that the currency price will increase in the future and they can profit from it. A short trade consists of a bet that the currency pair’s price will decrease in the future. Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading.

The comparative freedom from regulation on the forex and its high degree of possible leveraging makes it easy to control large trades. If you’re eager to start trading large amounts of capital, forex trading is for you. This is just one way in which forex markets are less regulated than stock markets. For some, the limits imposed by regulations may push them toward forex trading. Others see regulation as an extra layer of protection against fraud and wrongdoing, so they may prefer to trade in that environment.

As forex is a completely global market, you can trade 24 hours a day, five days a week. This provides you with ample opportunities for trading, but also creates the risk of the market moving while you aren’t around to monitor it. If you decide to trade forex, it is important to create a risk management strategy with appropriate stops and limits to protect your trades from unnecessary losses.

Forex prices are delayed 10 minutes, per exchange rules, and trade times are listed in CT. The fact is that millions of investors choose to trade Forex as it tends to be the best income-generating and investment opportunity. Now anyone can become a Forex trader and manage transactions from home or anywhere else easily uploading a mobile version of the latest trading platform to a smartphone. Advanced IT technologies allowed Forex to double in size during the past decade. Unfortunately, to start off in stock trading, you need at least $2000, and this is usually the minimum amount. For a healthy portfolio, it is even recommended to have at least $10,000 to start off, what makes stock trading not so affordable for novice traders.

If you’re planning to make a big purchase of an imported item, or you’re planning to travel outside the U.S., it’s good to keep an eye on the exchange rates that are set by the forex market. This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade. More interactive by using our virtual in-game $$ and trade on the forex stock market simulator.

of our customers open their account in less than 3 days

You have the right to access your personal data, the right to rectify it, deleteit, and the right to limit data processing. Trade forex securely and conveniently at your fingertips with the thinkorswim mobile app. Place trades, access technical studies and drawings on charts, explore education, and chat support all right on your mobile phone. But, before the lucky wind of change will lift your sail, you still need to decide which way to go.

You do not need to worry about market opening and closing hours and feel free to arrange your trade anytime you want. For many people Stock market seems to be more traditional way to make a profit from an investment. Simply say, to invest money you need to buy a small or big share of a company. Some stocks pay dividends when the company has done especially well.

Can forex be a full time job?

Becoming a Full-Time Forex Trader

Trading Forex full-time is a high-pressure job and once it becomes your only source of income, there is no margin for errors.

A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined. The blender costs $100 to manufacture, and the U.S. firm plans to sell it for €150—which is competitive with other blenders that were made in Europe. If this plan is successful, then the company will make $50 in profit per sale because the EUR/USD exchange rate is even. Unfortunately, the U.S. dollar begins to rise in value vs. the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00. After the Bretton Woodsaccord began to collapse in 1971, more currencies were allowed to float freely against one another.

Exclusive Trading Apps

When you buy shares in a company, you then own a small part of that company. The value of your part will change as the company’s share price moves up and down. With our stock trading service, you can’t open sell positions on stocks, but you can sell any holdings you have to earn a potential profit. The zulutrade minimum deposit forex or ‘foreign exchange’ market is a marketplace in which currencies can be bought, sold, and exchanged. The participants in this market range from banks, individual retail traders, and even travelers in need of local currency. Line charts are used to identify big-picture trends for a currency.

This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars for euros. Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. Trade some of the most popular shares with spreads from 0.08% on UK shares.

The opening hours of a market can have a significant influence over your trading, impacting the time you will need to spend monitoring the markets. For example, before the global recession of 2008 began, investors noticed a trend between the Nikkei stock index and the USD/JPY currency pair. As the Nikkei declined, investors would take this as a sign of weakness for the Japanese economy, and in turn, the USD would strengthen against the JPY. If the roles are reversed and the value of the Nikkei strengthens, the yen in turn strengthens against the USD.

How much money do you need to open a forex account?

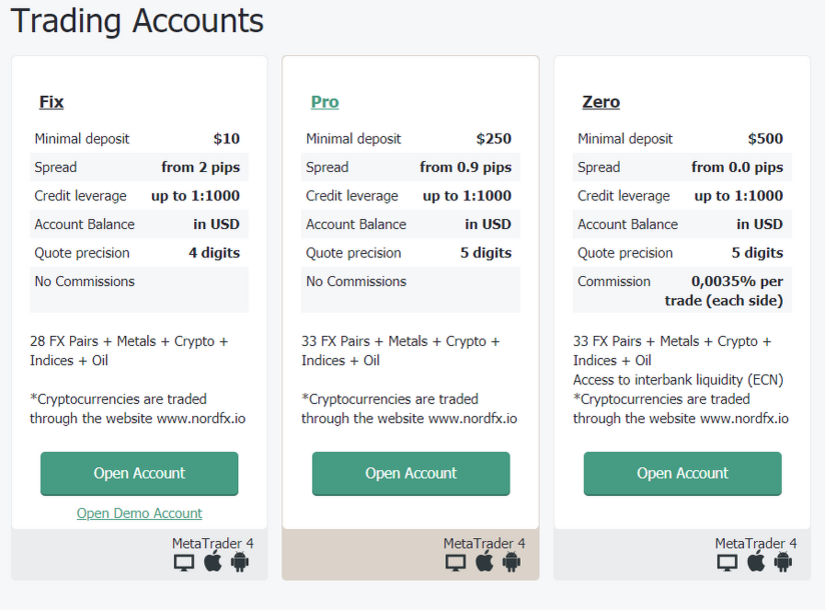

Capital Requirement: Most brokers require standard accounts to have a starting minimum balance of at least $2,000 and sometimes $5,000 to $10,000. Loss Potential: Just as you have the opportunity to gain $1,000 if a position moves with you, you could lose $1,000 in a 100-pip move against you.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Another factor to consider before trading forex or shares is what moves market prices. Primarily, both markets are influenced by supply and demand, but there are a host of other factors that can move prices. We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We’re also a community of traders that support each other on our daily trading journey.

However, the forex market, as we understand it today, is a relatively modern invention. Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps. Financial markets refer broadly to any marketplace where the trading of securities occurs, including the stock market and bond markets, among others.

You can make money trading both stocks and forex, using different strategies and practising a level of patience. However, the number of shares on the stock market is not always seen as an advantage over forex trading. Some traders prefer the reliability of trading a small number of top forex pairs that have remained in the market consistently, rather than deciding between existing, new and emerging possible stocks to invest in. For beginner traders, it is a good idea to set up a micro forex trading account with low capital requirements.

Pro News and Analysis

The following points characterize stock markets and stock market trading. When making your decision, you need take into consideration your trading style and financial goals. If you are interested in a fast-paced environment, forex provides ample opportunities for short-term traders – such as day traders, scalp traders or swing traders. If you’re looking to take advantage of short to mid-term trends, or less volatility, the stock market could be for you. The best time of day to trade forex is when the market is the most active, which is usually when two sessions overlap, as there will be a higher number of buyers and sellers. For example, if you were interested in GBP/USD, London and New York trading hours overlap between 12pm to 4pm .

Broadly speaking, the equities markets—blue chip stocks and index funds—suit a buy-and-hold investor, while active traders often prefer the fast-moving forex. This information has been prepared by IG, a trading name of IG US LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information.

The information contained on this site is intended for information purposes only. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately. Our trading platforms offer you a world-class trading experience with numerous features and tools that suit your trading style. In the context of investing, the terms “stocks” and “shares” have a similar meaning, and are often used interchangeably, particularly in American English.

Sign Up NowGet this delivered to your inbox, and more info about our products and services. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. Providing data is voluntary, but necessary for the conclusion of the agreement of information and educational service. Gold, oil, natural gas, coffee and more – don’t miss the potential of fluctuating prices.

What is the stock market?

Prior to a name change in September 2021, Charles Schwab Futures and Forex LLC was known as TD Ameritrade Futures & Forex LLC. The screenshot below shows how closely linked financial markets can be. The chart shows the EUR/USD currency pair and US Oil and it is apparent at first glance that those two markets aver very connected and often move in lock-step. But also Forex traders often pay close attention to commodity markets.

The Australian Dollar, for example, is closely linked to the price of Gold because Australia is a large Gold producer and exporter. When Gold prices fall, the Australian economy and the Australian Dollar are heavily impacted. For example, copper, which is used in constructions, can provide insights about the state of the economy. When copper prices start rising, it could signal that demand is increasing and that the economy is growing which could lead to an appreciation in equity markets . Currencies are also a much more complicated market than stocks.

How does forex make money?

In return for executing buy or sell orders, the forex broker will charge a commission per trade or a spread. That is how forex brokers make their money. A spread is a difference between the bid price and the ask price for the trade.

These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. Commodity markets are also closely watched by traders and investors who participate in other markets and commodity prices also influence other financial markets. Forex trading is generally less regulated than stock trading, and forex traders have access to much more leverage than stock traders.

What is the Forex market?

All our clients receive the same quality services, the same execution, and the same level of support. XM sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. Trading on leverage enables you to gain exposure to markets with just a fraction of the capital normally required. Leveraged products, such as spread betting and CFDs, can be used to trade on margin across a range of markets.

It is active across almost every time zone and gives traders an opportunity to trade 24 hours a day and five days a week. When the market closes varalen capital markets in the U.S. the trading day starts in Tokyo and Hong Kong. Time flexibility is very convenient for traders who have a busy working schedule.

A focus on understanding the macroeconomic fundamentals that drive currency values, as well as experience with technical analysis, may help new forex traders to become more profitable. The average daily range in price movement of the e-mini contracts affords great opportunity for profiting from short-term market moves. Of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The difference between these two amounts, and the value trades ultimately will get executed at, is the bid-ask spread. Stocks represent equity shares of companies and the individual stocks of one country are combined together hammer doji in a so-called stock index. By following the index of a certain stock market, investors can quickly identify the sentiment and the state of that economy. Forex trading is absolutely not a good choice for novice investors.

Single-stock ETFs are a new exchange-traded product that allows for leveraged or inverse trading of single stocks. Specific elements to compare include volatility, leverage, and market trading hours. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA.

By examining past data, traders are sometimes able to identify highs and lows, so that they can buy and sell at the best times to make the most amount of profit. When deciding between forex and the stock market, it is important to identify all the opportunities available to you – notably, can you short sell? The ability to short a market opens you up to a whole new dimension of market movements, enabling you to speculate on both rising and falling markets. Trading volatility can potentially provide a lot of opportunities for traders to profit, but it also comes with increased risk, making it important to take steps to prevent unnecessary loss. Liquidity is the ease at which an asset can be bought or sold in a market. Taking into consideration all above points, there is no simple conclusion for which market is more profitable.

Therefore, as they are not looking for short-term price fluctuations, a volatile market would not work for their trading strategy. Trading hours differ between the forex market and the stock market. The forex market is open 24 hours a day, 5 days a week, due to the overlap between time zones. On the other hand, there is a set daily timetable for stock market trading hours, depending on the specific region and exchange.